ISO 55001:2024 introduces the concept (and requirement for) a “Decision-Making Framework”. This has caused some consternation amongst those seeking alignment or certification with the standard. This article cuts through the confusion and presents a simple framework and approach which will assist those wishing to align or conform with this element of ISO 55001:2024.

Asset Management Decision-Making

In most organisations, the processes for making Asset Management decisions are already documented, or if not formally documented, tend to be well-established in custom and practice. Pulling these together into an integrated decision-making framework is not necessarily as complex as it might, at first, seem.

This article presents an approach that can be used for:

- identifying the decision-making processes that should be documented

- capturing or developing the required documentation

- integrating the decision-making processes and ensuring that they are aligned with the achievement of asset management and organisational objectives.

Introduction

One of the biggest changes between the 2014 and 2024 versions of ISO 55001 was the introduction of Clause 4.5 relating to the documentation of a “Decision-Making Framework”.

In ISO 55001:2014, the key references to decision-making were included in Clause 4.2 – “The organization shall determine… the criteria for asset management decision making” (ISO, 2014, p. 1) and Clause 6.2.1 – “The asset management objectives shall … be established and updated using asset management decision-making criteria” (ISO, 2014, p. 4). This version of the standard did not include any detail regarding what was meant by “decision-making criteria” or how decisions should be made.

In comparison, Clause 4.5 in ISO 55001:2024 (ISO, 2024, pp. 5-6) contains three subclauses and 279 words relating to the requirements for a Decision-Making Framework to be regarded as conforming to the Standard.

This significant change has caused some consternation amongst those seeking certification (or re-certification) to ISO 55001, as it appears, at first glance, that significant work is required to be able to demonstrate conformance with this new Clause 4.5. In practice, in most well-run organisations, this is not necessarily the case.

Key Definitions and Concepts

Let’s start by understanding what is meant by a “decision” and, in the context of Asset Management, what a “good” asset management decision looks like.

What is a Decision?

The Cambridge Dictionary defines a decision as being:

a choice that you make about something after thinking about several possibilities (Cambridge Dictionary, 2025)

The average adult makes 33,000 to 35,000 decisions each day (Reill, 2023). Do we need to establish a decision-making framework and associated decision-making criteria for every one of these decisions? Clearly not. It would simply be impractical to do so.

In reality, many of these decisions are made subconsciously. Furthermore, the impact of making a “bad” decision for many of those decisions is minimal.

However, there are a few decisions that we make each day that require more considered thought and require conscious thinking. Having a structured process for making these types of decisions that result in better and more consistent outcomes is likely to be valuable.

What is a Good Asset Management Decision?

Asset Management is defined as being “coordinated activity of an organization to realise value from assets” (ISO, 2024, p. 3). It is logical, therefore, that a good asset management decision is one which results in the greatest value being realised from the organization’s assets.

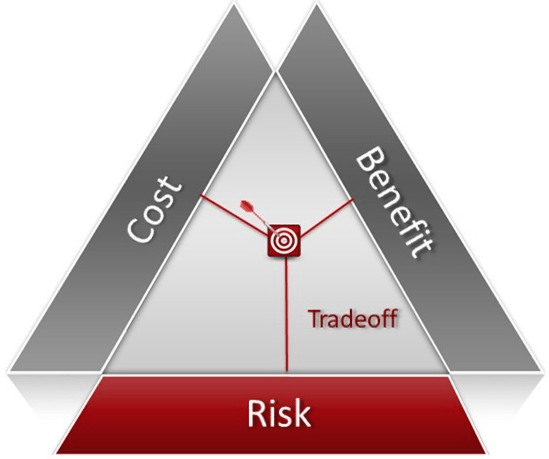

This, in turn, requires us to understand the concept of value as it pertains to Asset Management. In general, it is useful to consider value as being the optimal trade-off between Costs, Benefits and Risks/Opportunities over time, as illustrated in Figure 1.

Where that trade-off sits varies from organisation to organisation and depends on the needs and expectations of the various internal and external stakeholders of that organisation (such as shareholders, customers, regulators etc.), and the organisation’s strategic approach for meeting those conflicting needs and expectations.

A “good” Asset Management decision, therefore, is one which, as far as is practicable, aligns with the organisation’s preferred trade-off position relating to costs, benefits, risks/opportunities and time.

ISO 55001:2024 Requirements Regarding the Decision-Making Framework

Let’s turn now to explore some of the specific requirements contained in Clause 4.5 of ISO 55001:2024, and how organisations can demonstrate compliance with those requirements.

Value

Clause 4.5.1 in ISO 55001:2024 contains the following requirement:

The decision-making framework shall be used to:

— define and determine the value that the organization aims to derive from its assets by applying the asset management system; (ISO, 2024, p. 6)

As discussed earlier, value can be considered as the optimum trade-off between costs, benefits, risks/opportunities and time. There is a requirement, therefore, for organisations to “define and determine” the sweet spot for this trade-off that represents the organisation’s view of optimum value. How can organisations do this?

I suggest that organisations can do this by having a formal and rigorous process for determining and defining its organisational objectives, and the related Asset Management objectives. Let’s explain.

An objective is defined as being a “result to be achieved” (ISO, 2024, p. 5). Good practice suggests that objectives should be SMART – Specific, Measurable, Achievable, Realistic and Time-bound. Organisations could, and should, establish SMART objectives in several dimensions. These could include setting targets relating to, for example, output/production, costs, safety, environmental performance etc. These objectives can both be short-term in nature (this year’s targets for example) and longer-term (e.g. a 5-year target). It is not hard to see that each of these objectives defines the target level of performance in each of the four key dimensions of value – Costs, Benefits, Risks/Opportunities and Time. This set of objectives could, therefore, be used to define “value” for the organisation.

The challenge, however, for most organisations, is in making sure that each of these objectives are integrated and aligned with each other, and that therefore, when considered as a set of objectives, they represent an achievable, optimum balance between each of these dimensions. The unfortunate reality is that often the objectives in each dimension of cost, benefit, risk/opportunities and time are established in isolation, with minimal effort taken to understand the interaction between them, and the impact of achieving the objective in one dimension on the probability of achieving the targets in the other dimensions. Objectives such as “Zero Harm”, for example, while seeming admirable, cannot be achieved without spending significant sums of money, and may also have an impact on organisational outputs if operations are stopped to deal with every minor potentially harmful incident.

The opportunity exists, therefore, for organisations to improve the way that they develop and integrate their organisational and Asset Management objectives to better define value – and as a result, provide better guidance to those making decisions that have potential to impact on the achievement of that value.

Decision-Making Criteria

Clause 4.5.1 in ISO 55001:2024 contains the following requirement:

The decision-making framework shall be used to:

— define the criteria to be used for asset management decision-making to achieve the determined value; (ISO, 2024, p. 6)

Unfortunately the terms “criterion” and “criteria” are not defined in the standard. Instead, we must resort to common dictionary definitions such as the one in the Cambridge Dictionary:

a standard by which you judge, decide about, or deal with something (Cambridge Dictionary, 2025)

In interpreting this definition, it seems sensible to consider that the term “standard” as used in this definition could incorporate an objective measurement (for example, the Internal Rate of Return of all capital projects must exceed 15%) or a process by which a decision is made (for example, the capital investment decision-making process) or some combination of the two. This latter interpretation is embraced in Clause 4.5.3 of ISO 55001:2024 (ISO, 2024, p. 6) which describes the requirements relating to decision-making processes, methods and tools.

However, if we consider, as mentioned earlier, that the average adult makes 33,000 to 35,000 decisions each day, that is a lot of decisions for which we need to establish decision-making criteria! Fortunately, however:

- Not all decisions are important, and therefore deserving of considered thought, and

- Not all decisions are Asset Management decisions

We clearly need to whittle down the 33,000 to 35,000 decisions made each day to a smaller number for which we need to establish decision-making criteria, and ISO 55001:2024 is aware of that. Clause 4.5.2 in ISO 55001:2024 outlines the factors to be considered when developing the criteria to be used for asset management decision-making. These include:

- the potential impacts of the decisions, including the time period over which such impacts can occur;

- the complexity of the decisions;

- the urgency or time available for making the decisions;

- capabilities appropriate to the above. (ISO, 2024, p. 6)

Let’s deal with each of these in turn.

Potential Impacts of Decisions

A practical way of assessing the potential impact of the different types of decisions we make is by considering them in the context of their potential to impact on the achievement of Organisational and Asset Management objectives. If these objectives have been established well (see Section 3.1 above), then, in combination, these objectives reflect the organisations definition of value.

If we consider them in that way, then the process of categorising the potential impacts of different types of decisions might look like the following:

- Establish a list of the types of Asset Management Decisions that are made. When making this list, a good starting point is the decision-making processes that you already have documented. You will find that you most likely already have documented processes in areas such as Capital Investment Decision-Making, Capital Budgeting, Operational Budgeting, Management of Change, Preventive Maintenance Program development, Work Order prioritisation etc.

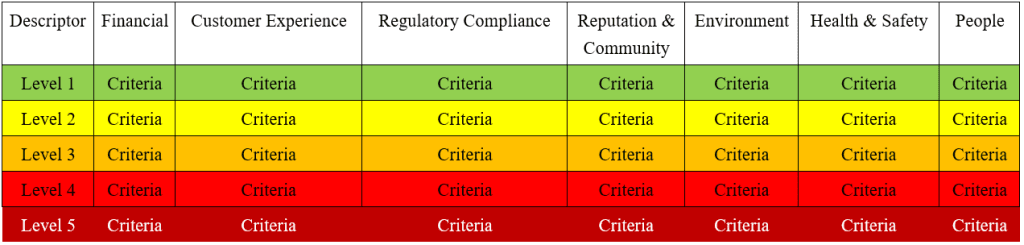

- Establish criteria, for each of the specified objectives, against which the potential impact of decisions can be assessed. This could, and should, be related to the criteria used for assessing the level of consequences in the corporate risk matrix. A sample is shown on the next page as Table 1.

- Assess each of the types of Asset Management Decisions against those criteria, assuming that no formal decision-making processes for those types of decisions exist.

Table 1 – Consequence Definitions

As a general rule, the greater the level of consequence, then the higher the level of rigour that should be applied when making those decisions.

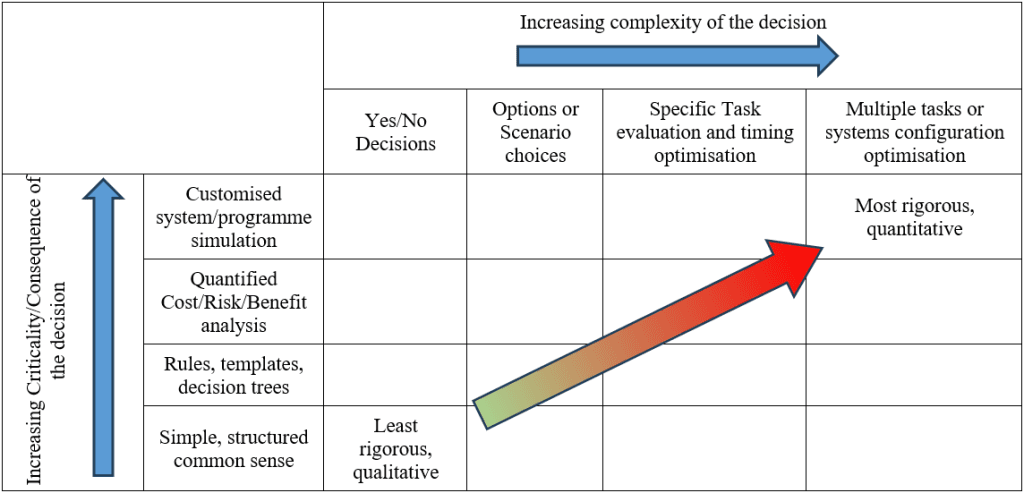

Complexity of Decisions

In a similar manner, the degree of complexity associated with certain types of decisions can also be ranked. Once again, as a general rule, more complex decision will require more complex tools or models to be applied when making those decisions. This will often be the case when there are many alternative solutions available. In other cases, the range of options available may be more limited, and the methods used to evaluate those options may be able to be simpler. In extreme cases, the decision may simply require a yes/no answer.

Putting these two factors together may result in a matrix similar to that shown in Table 2 (adapted from (IAM, 2015, p. 17)), which can be used to determine what type of decision-making process and/or tool may be suitable in each situation.

Table 2 – Consequence/Complexity Matrix

The Urgency or Time Available for Making the Decision

The amount of time available for making a decision may limit the level of rigour and/or the approach to be taken for making the decision. This may overrule the guidance provided in Table 2. However, the level of risk (in terms of the impact on the achievement of Organisational and Asset Management objectives) associated with a fast-track decision-making process should be assessed before adopting such an approach. Ideally, these risks should be identified and addressed in a proactive manner by performing the analysis with a suitable degree of rigour before the need for urgency arises. For situations which represent high levels of risk, the resulting outputs can then be incorporated into contingency plans

Capabilities relating to the Above

Clearly, organisational decision-making capabilities and competences need to align with those required to execute the selected decision-making process. If these do not align, then a decision would need to be made to either:

- Acquire/develop the required competences/capabilities, or

- Amend the decision-making process or tools to be used

Which of those is the better decision would need to be made in accordance with an appropriate decision-making process!

How Does this Work in Practice?

All of the above is highly conceptual and theoretical. But in practice, how would an organisation demonstrate that they have an effective decision-making framework in place?

In reality, all organisations already have decision-making processes in place, and, for critical decisions, almost all of these processes will be documented. For example,

- Capital Investment Decision-Making

- Capital and Operational Budgeting

- Management of Change

- etc.

These documented processes should be sufficient, in almost all cases, to satisfy the requirements of Clause 4.5 of ISO 55001:2024 so long as they can be shown to be:

- Aligned with the corporate definition of value (will they result in the desired organisational and asset management outcomes), and

- Consistently applied

So, in practice, all that is really required for most organisations is to:

- Ensure that a balanced and integrated set of SMART objectives are established for the organisation and for Asset Management

- Identify the most critical decisions that are made within the organisation (in terms of their potential to impact on the achievement of organisational and asset management objectives),

- Ensure that the process for making these decisions is documented, and aligns with the achievement of the organisational and asset management objectives, and

- Ensure that the documented processes are consistently applied.

As a side note, be aware that the decision-making processes need to be fit for purpose for the size and nature of the organisation. For smaller organisations, it may be appropriate that some decisions are delegated to a specific individual to make. If this is the case, then this should be documented also.

Note also that Clause 6.2.1 (b) of ISO 55001:2024 requires the decision-making framework to be included within the Strategic Asset Management Plan (SAMP) (ISO, 2024, p. 9). However, as Clause 6.2.1 also permits the SAMP to consist of a combination of separate documents, there should be no need to develop a separate, specific document containing the decision-making framework. It may make sense, however, to point to the documents containing the relevant decision-making processes from within the SAMP.

References

Cambridge Dictionary. (2025, 04 02). CRITERION | English Definition. Retrieved from Cambridge Dictionary: https://dictionary.cambridge.org/dictionary/english/criterion

Cambridge Dictionary. (2025, 04 02). DECISION | English Meaning. Retrieved from Cambridge Dictionary: https://dictionary.cambridge.org/dictionary/english/decision

IAM. (2015). SSG 8 – Life Cycle Value Realisation. London: Institute of Asset Management.

ISO. (2014, 12 15). ISO 55001:2014 – Asset management – Management systems – Requirements.

ISO. (2024). ISO 55000:2024 – Asset management — Vocabulary, overview and principles.

ISO. (2024). ISO 55001:2024 – Asset management — Asset management system — Requirements.

Reill, A. (2023, 12 5). A Simple Way to Make Better Decisions. Retrieved from Harvard Business Review: https://hbr.org/2023/12/a-simple-way-to-make-better-decisions

Does your organisation require assistance to align with ISO 55001?

We have over 25 years of experience in delivering tailored, holistic asset management solutions to a wide range of businesses. To learn more about our consulting services, follow the links below.